Aussie resources ETFs tipped for another solid year

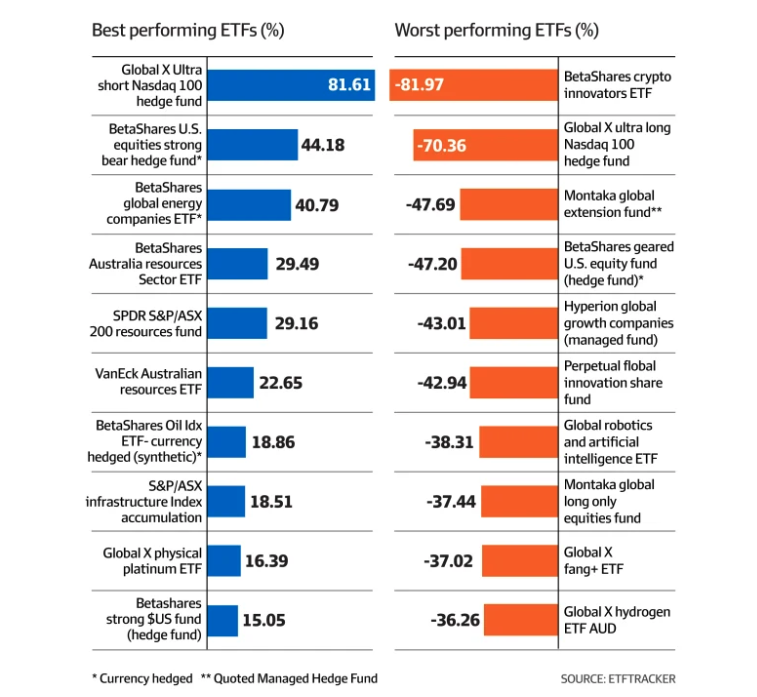

January 20, 2023Australian Resources equity exposures have been identified as amongst the strongest performers in Betashares End of 2022 Review of the local ETF industry.

In penning his annual review for 2022, Betahares’ ETF industry specialist, Ilan Israelstam, noted that Global Energy and Australian Resources equity exposures were popular sectors in 2022, behind short-leveraged US equity exposures.

According to the Betashares review, in a highly turbulent year in financial markets, the ETF industry continued to take in new money from investors, even as asset values declined, making it one of the few bright spots in a challenging year for the broader asset management industry.

Mr Israelstam reported that in total, the Australian ETF industry received $13.5 billion of net inflows in a year where the unlisted funds industry sustained net outflows of —$26.8B, marking the worst year on record for Australian managed funds.

“The ETF industry’s positive net flows were, however, not enough to combat the asset value declines caused by falling share and bond markets, and, as a result, the industry itself fell in value by 2 per cent,” he noted.

The report identified very robust net flows in 2022, particularly given the broader picture for funds management, amounting to $13.5B (42% lower than the net flow figure recorded in 2021, $23.2B, the highest net flows on record).

It found that overall, the mix of flows by category shifted in 2022 vs. 2021, with global equity flows more muted than in previous years – investors seemingly concerned over the market volatility experienced by global sharemarkets.

“As such, it was the Australian Equities category that led flows,” Israelstam said.

“Fixed Income mounted a comeback vs. 2021, to become the second most bought category of ETFs in 2022 with investors more willing to invest this asset class as yield rises began to taper off.”

Meanwhile, David Bassanese, a Betashares specialist in Macro and Markets, has forecast a strong year for the Australian resources sector in 2023.

“The Australian resources sector – which has done relatively well over the past year – would most benefit from the economic boom scenario, mainly if led by a strong rebound in the Chinese economy,” Bassanese said.

“Australia’s other important sector – financials – might fare better with a continuation of the stagflation scenario, with bond yields high and the economic outlook somewhat cautious.”

“This will be a challenging year for investors, with the precarious US economic outlook potentially the biggest driver of returns,” he added.

“The balance of probabilities suggests good prospects for improved bond returns in the coming year, though likely more near-term downside risk for equity markets. In turn, this favours more defensive equity exposures and a bias towards the US dollar over the Australian dollar.”

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.