Rio Tinto (ASX:RIO) emerges from the gloom

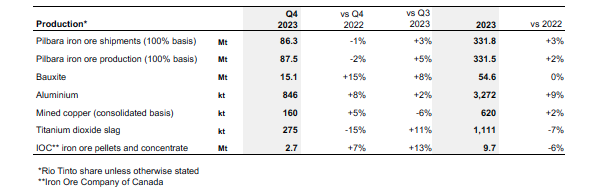

January 16, 2024Rio Tinto’s copper production increased by over 3% in Q4 2023, attributed to the Gudai-Darri mine reaching its nameplate capacity and deployment of the Safe Production System.

It contrasts sharply with the world’s second-largest miners’ gloomy outlook one year earlier when it downgraded its expectations for refined copper production, alumina production, and output at its Canadian iron ore operations and warned of rising costs.

The Kitimat aluminium smelter had returned to full capacity, and the company had benefited from its increased ownership in Oyu Tolgoi as the underground ramps up.

Simultaneously, the world’s second-largest mining company entered the recycled aluminium market in North America and made progress on the world-class Simandou iron ore project in Guinea.

“We were fatality-free for the fifth consecutive year at our managed operations, but we remain vigilant and continue to learn from safety incidents,” Rio Tinto CEO Jakob Stausholm said.

“We continue to work hard to transform our culture and to invest in deep engagement and partnerships with Traditional Owners, such as our agreement to explore renewable energy projects with the Yindjibarndi Energy Corporation.

“There is good demand for the materials we produce, and our purpose and long-term strategy make more sense than ever. The work we are doing today is creating a stronger Rio Tinto for years to come, as we invest in profitable growth while continuing to deliver attractive shareholder returns.”

More growth is in the pipeline with a new copper joint venture with Codelco launched in December 2023.

Screen Shot 2024 01 16 at 6.37.14 am

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.