Elixir (ASX:EXR) to share Grandis daydreams with Origin (ASX:ORG)

November 6, 2023Elixir Energy will share information about an energy super-basin well with Brookfield Asset Management and MidOceanEnergy‘s snap-up Origin Energy in exchange for a gas $1 million funding.

Under Elixir’s information sharing agreement with Origin, it will collect information on the Daydream-2 well it plans to spud this week.

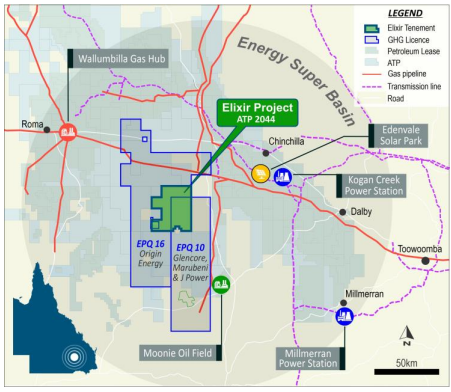

The well forms part of its wholly owned Grandis Gas project on the ATP 2044 tenement in Queensland near Roma and Toowoomba.

Screenshot 2023 11 06 084125

Origin has a Greenhouse Gas licence pending for an area that overlaps Elixir’s tenement, EPQ 16, in a larger area where Origin plans to investigate carbon capture and storage.

Elixir will collect the $1 million without diluting its Daydream-2 well funding.

Rather than Origin drill its well, Elixir will collect information for the company, with the Brookfield-MidOcean target able to take up an option over up to five other wells that Elixir will drill in its tenement.

“We are very pleased to announce another non-dilutive source of finance for Daydream-2,” Elixir Managing Director Neil Young said.

“This innovative deal provides an excellent win-win-win for Elixir, Origin – and the State of Queensland – in that one well will provide sub-surface data that would otherwise require two wells.

“It is Elixir’s firm view that the co-location of natural gas and CCS (and renewables) – forming what Wood Mackenzie has dubbed ‘energy super-basins’ – will increasingly form key areas of interest for global energy investors.”

Another source of non-dilutive funding for Daydream-2 well funding is the Australian Government, previously tipped to pay up to 43.5 per cent of the well’s total costs.

About Grandis project

Elixir’s Taroom Trough area tenement near Moonie oil field, Wallumbilla gas hub and two power stations are part of an area dubbed an energy super-basin.

The Grandis Gas project, where the tenement is located, holds an initial contingent resource of 365 billion standard cubic feet of gas that is based on past estimates of gas in place within the coal fracture system.

Shell is drilling a tenement to the west of Elixir. At the same time, Glencore, Marubeni & J-Power have an area to the east they are targeting that overlies Elixir’s tenement and Origin’s.

Deep coal flow from Daydream-2 and other wells will likely provide a significant material increase to Elixir’s Grandis resource.

The Taroom Trough area has been the focus of Australia’s coal seam gas and LNG export industry since 2014 and had its early hydrocarbon potential realised through conventional discoveries.

The source rocks are known to produce massive quantities of oil and gas but with only a tiny portion trapped in conventional structures, implying a hefty volume could be trapped in tight reservoirs, which Elixir sees as an untouched opportunity.

About Origin’s sale

In deals given the tick-off by the nation’s competition regulator, the ACCC, a Brookfield Global Transition Fund will snap up Origin’s energy markets business, including its gas retail businesses. At the same time, MidOcean will acquire Origin’s upstream gas interests.

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.