Summit (ASX:SUM) rearing a rare earth Stallion

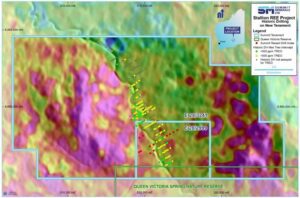

March 24, 2023Summit Minerals have expanded its exciting Stallion rare earth project by a whopping 720 per cent, bringing it to 162.19 square kilometres of territory in the southern end of Western Australia.

Drilling on Summit’s adjacent holdings recently outlined a 2.5 square kilometre zone averaging around 1750 parts per million total rare earth oxide rich in sought-after neodymium and praseodymium, known to extend and believed to shallow onto its new tenement.

The compelling results come from much shallower depths than those generated by the previous owner, and an NdPr number of 23.63% which stands shoulders above the industry average of 16% provides more allure for a rare earth discovery which remains open in all directions and holds vast scalable potential.

Managing Director Jonathan King said it was suitable timing for the grant of title.

“The recently completed drilling program on the adjacent tenement alluded to the substantial scale potential available at Stallion, particularly to the west of Ponton Creek, where the mineralisation shallows and the potential source rocks daylight,” he said.

“The scale potential is captured upon receiving the title, and the Company is keen to prospect its new title as soon as practicable.”

Historical drilling by the Manhattan Corporation in times of lesser rare earth interest supported further mineralisation north of Summit’s drilling and the E28/2999 licence. The explorer will complete analysing the previous owner’s database while prospecting its new tenement.

Radiometric thorium draped over the digital terrain model shows the relationship between

tenements

Rare earths coexist with radioactive elements. While often seen as an added mining risk, Summit has utilised the significant presence of uranium in the tenements to strengthen Stallion, conjoining a 3.3-million-pound triuranium octoxide inferred resource to a now-expanded rare earth opportunity.

Next Steps

Trial leach work has begun with LabWest, and Summit will now advance west of Ponton Creek, continuing rare earth liberation work as it begins prospecting for further mineralisation across the entire western flank captured by its tenements, with early work including field survey, chip sampling, passive seismic results and surface geochemistry ahead of drilling.

SUMMIT FPO

SUMMIT FPOPlease note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.