PAM Acquires 100% Interest in Tama Atacama Lithium Brine Project

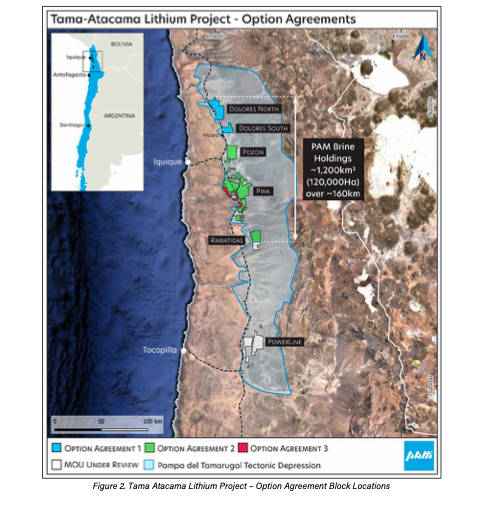

January 2, 2024Santiago, Chile – Pan Asia Metals (ASX: PAM) has signed formal documentation to acquire 100% interest in the ~1,200km2 Tama Atacama Lithium Brine Project in a significant move that could significantly impact the global lithium market.

The project is one of South America’s most significant lithium brine projects, with holdings across three scalars.

Pan Asia Metals’ Tama Atacama Lithium Project has high lithium surface assays, strategic positioning, and available waste and water balance solutions. The project is in Chile, where multinational mining and chemical companies have made strategic moves in Chilean lithium.

According to the company, the acquisition was made possible by converting Memorandums of Understanding (MOUs) into binding Option Agreements to Purchase 100% of the Tama Atacama Lithium Brine Project.

The project reportedly features extensive lithium surface anomalies with elevated lithium results up to 2,200ppm Li and averaging 700ppm Li (270ppm Li cutoff) extending over 160km north to south.

PAM already has discussions with potential strategic partners and considers the Tama Atacama project a Tier 1 asset in a Tier 1 jurisdiction. The company plans to commence geophysics and drilling in early 2024.

The Option Agreements have timelines and expenditure commitments that are attractive and achievable compared to similar lithium brine project transactions in Chile and the United States.

This acquisition could position PAM as a significant player in the global lithium market, projected to experience significant growth in the coming years due to the increasing demand for electric vehicles and renewable energy storage

“The Tama Atacama Lithium Project has the potential to be one of the largest lithium brine projects in the global peer group. Surface assays for lithium are extremely high and the project has enviable strategic positioning, with all infrastructure requirements satisfied,” Pan Asia Metals’ Managing Director Paul Lock said.

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.