Interest rate cuts fuel cautious uncertainty

January 2, 2024The Reserve Bank of Australia (RBA) is expected to cut interest rates in September, following in the footsteps of other advanced economies such as the US Federal Reserve, the European Central Bank, and the Reserve Bank of New Zealand.

This move may attract yield-hungry investors to pursue higher interest rates in Australia, leading to an increase in the strength of the Australian dollar. However, the timing of the RBA’s tightening cycle remains uncertain.

The RBA will only hold eight meetings a year from next month, instead of 11, and faces the challenge of population growth, with 500,000 migrants arriving last year, which could contribute to inflationary pressures.

Some experts predict a rate cut in the September quarter, while others believe the tightening cycle is over and rate cuts may not begin until the second half of 2024.

Bond traders imply a one in five chance of a rate reduction by March, fully priced for the first move in June and a follow-up in November. The question remains whether the RBA will raise rates in February or be influenced by other central banks’ anticipated easing.

Leading economists around the country are voicing concern that uncertainty surrounding the RBA’s decision could have significant implications for investors and the Australian economy.

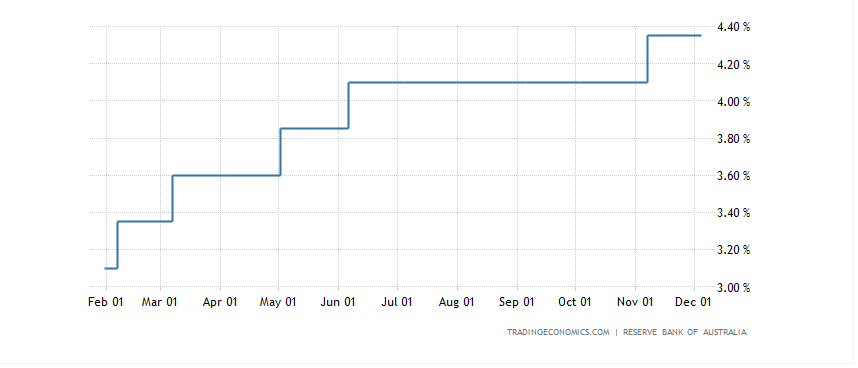

Australian Interest Rates

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.