Duketon Mining (ASX:DKM) reports further gold intercepts at Killarney

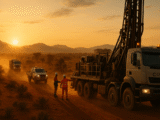

November 26, 2025Duketon Mining has provided a detailed update on its second reverse circulation drilling program at the Killarney Gold Project in Western Australia, with assay results confirming the continued presence of gold across the targeted structural corridor.

The latest results add geological context to an emerging mineralised system while highlighting variability in grades that the Company attributes to the nature of the deposit.

Highlights

- Assays received from the second RC drill program at Killarney.

- Intercepts include 4 metres at 1.63 grams per tonne gold from 55 metres, including 2 metres at 2.99 grams per tonne gold.

- Additional results include 3 metres at 1.18 grams per tonne gold from 76 metres, 2 metres at 1.32 grams per tonne gold from 72 metres, 8 metres at 0.68 grams per tonne gold from 36 metres, and 8 metres at 0.84 grams per tonne gold from 68 metres.

- All holes targeting the structure intersected gold.

- Samples have been resubmitted for PhotonAssay analysis to assess potential nugget effects, with results expected within eight weeks.

The Killarney Project, located 63 kilometres east of Mount Magnet and about 80 kilometres west of Sandstone, has now seen two phases of reverse circulation drilling, with the second campaign comprising eighteen holes for 1,560 metres.

According to the Company’s release, drilling to the east of the historic shallow Killarney pit intersected heavily weathered ferruginous saprolite with variable quartz veining, while further east the targeted structure was intersected in fresh rock.

These geological contrasts provide additional insight into the distribution of mineralisation encountered to date.

Assay results reported across several holes show continued intersections of gold within the structural corridor, with downhole widths including 4 metres at 1.63 grams per tonne gold from 55 metres in hole 25KRC020 and 3 metres at 1.18 grams per tonne gold from 76 metres in hole 25KRC031.

The Company notes that grades returned in this program were generally lower than those from the previous campaign, although the variability is considered consistent with characteristics typical of nuggety or structurally controlled systems.

Duketon Mining’s Managing Director, Stuart Fogarty, said,

“The latest drilling results from Killarney continue to strengthen our confidence in the scale and continuity of the mineralised system. Importantly, every hole targeting the structure has intersected gold, further validating our interpretation of a robust mineralised corridor.”

The Company reports that logging of fresh geological and structural information has been central to refining interpretations.

The integration of assay trends, structural data and logged lithology will now underpin a reassessment of the exploration model as Duketon works to identify and prioritise targets that may host higher grade zones within the broader system.

The dataset also reflects natural variability in gold distribution across the mineralised zone.

The Company highlights that this variability is common in the type of structurally controlled system encountered at Killarney and considers the repeated presence of gold across multiple drill sections a constructive indicator of system continuity.

No top cuts were applied to results, and reported intercepts were calculated using length weighted averages with a 100 parts per billion gold threshold and up to two metres of internal dilution.

Duketon will now undertake PhotonAssay testing to assess the potential influence of nugget effects on gold distribution while incorporating new geological and structural information into its next phase of modelling.

With all targeted holes intersecting mineralisation and further analysis underway, the upcoming drilling program will focus on defining areas that may deliver higher grade outcomes within the established mineralised corridor.

The Company intends to update shareholders as preparation for the next campaign progresses.

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.