Trigg Minerals (ASX:TMG) moves into Idaho with antimony-gold acquisition and Tribeca backing

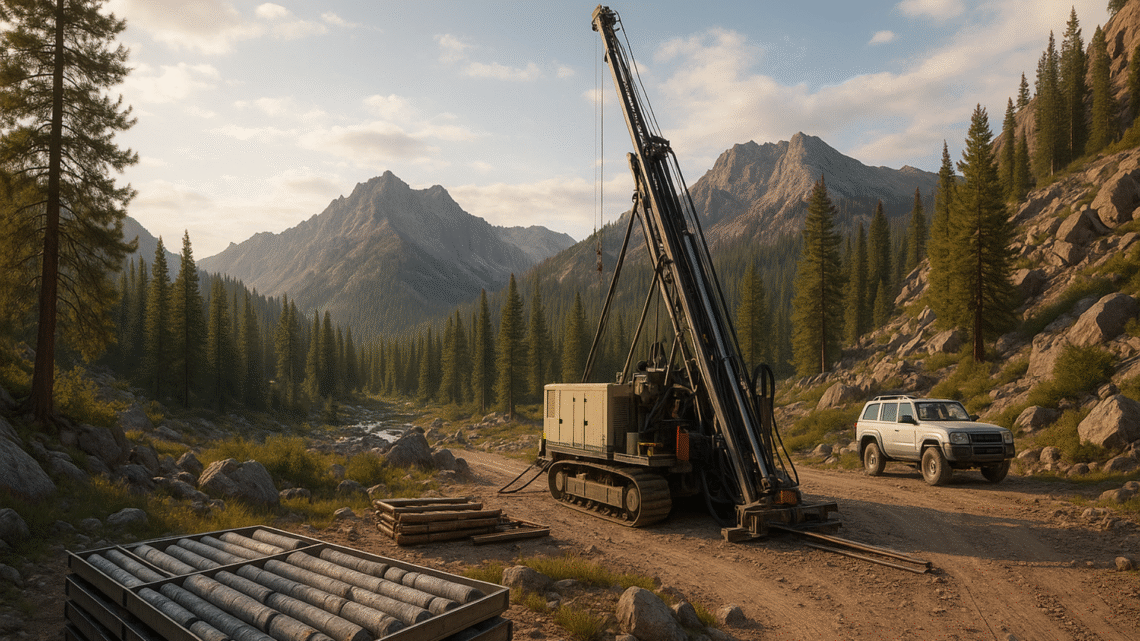

September 24, 2025Trigg Minerals (ASX:TMG) has taken a decisive step in its US critical minerals strategy with the acquisition of the Central Idaho Antimony Project, a district-scale landholding in one of North America’s most underexplored mineral belts.

The project, located in the Tier 1 jurisdiction of Idaho, extends the company’s growing portfolio in the United States alongside the Antimony Canyon Project in Utah and Tennessee Mountain tungsten ground in Nevada.

Highlights

-

100% acquisition of the Central Idaho Antimony Project in Elmore County, Idaho.

-

$5 million strategic placement to Tribeca Investment Partners.

-

Rock chip assays up to 17.6% antimony and 3.1 g/t gold.

-

Geological parallels with Perpetua Resources’ Stibnite Gold Project, recipient of over US$80m in federal support.

-

Minimal historical environmental impact supporting a clearer permitting pathway.

The Central Idaho Antimony (CIA) Project sits within the historic Swanholm District, where high-grade antimony and precious metals were mined in the mid-20th century.

While historical workings were shallow and selective, recent rock chip assays confirm impressive results, including 17.6 per cent antimony from historical pits and gold assays up to 3.1 grams per tonne.

The geological setting mirrors that of Perpetua Resources’ Stibnite Gold Project to the north, which has already attracted substantial US Department of Defence backing to reinforce domestic supply of critical minerals.

A distinguishing feature of the CIA Project is its clean environmental slate, with ore historically processed off-site and leaving the project free of legacy tailings and contaminants.

This could shorten permitting timelines, an important factor given Washington’s increasing focus on reducing reliance on foreign supply chains for minerals such as antimony, which currently has no US production.

The acquisition has been accompanied by a $5 million strategic placement to Tribeca Investment Partners, a move that brings institutional credibility and financial strength to Trigg’s register.

The funds will support systematic trenching, adit re-opening and district-wide mapping, designed to define drill-ready targets and test the potential for both high-grade direct shipping ore and larger bulk-tonnage systems.

Managing director Andre Booyzen said:

“It is exceptionally rare to secure a project of this scale in a Tier-1 jurisdiction, particularly with assays up to 17.6% antimony and multiple high-grade gold results confirming the presence of a robust mineralising system. With no current US production of antimony and a minimal historical environmental footprint, we see a clear pathway to development.”

Looking ahead, Trigg Minerals intends to fast-track exploration at Central Idaho while leveraging Tribeca’s backing and connections.

The combination of high-grade results, a Tier 1 jurisdiction and a clean permitting pathway provides a strong foundation for the company’s ambition to establish itself as a key supplier of critical minerals into Western supply chains.

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.