Summit (ASX:SUM) shows exceptional REE at Stallion Project

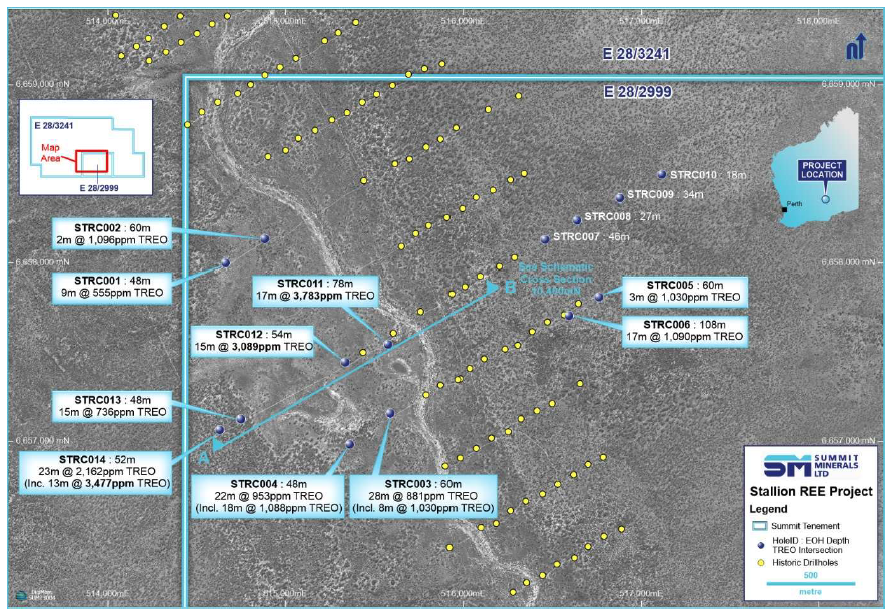

March 8, 2023Summit Minerals have reported broad, thick and shallow rare earths up to 3,783.4 ppm TREO as part of its proof-of-concept drilling at the Stallion REE Project in Western Australia.

Adding to the prize, critical permanent magnet metals, NdPr were revealed at 23.63%, well above the 16% industry average.

The outstanding results trump historical with new drilling outlining a priority a kilometre square zone of potential mineralisation that remains open in all directions.

Drill hole location plan with drilling intercepts and tenements.

“We are delighted to have generated such compelling numbers from much shallower

depths than those encountered in the earlier Manhattan Corporation drilling,” Summit Managing Director Jonathan King said.

“The step-out drilling produced several suitably wide intersections and total rare earth oxide (TREO) grades exceeding 1,000 ppm, with a peak value of 1.52% TREO. Other notable results include the high ratios of valuable, critical magnet metals, neodymium (Nd) and praseodymium (Pr), and dysprosium (Dy) and terbium (Tb), averaging 24.95% ((NdPr) + (DyTb)).

“The scale potential is vast with the indicated mineralisation on a 1km x 1.25km grid. It remains open in all directions, and the trend pushes into our adjacent application (E28/3241).”

A Rare Market Opportunity.

Growth for rare earth materials driven from renewable energy, electronics, and other high-tech areas is projected to reach USD$9.6 billion by 2026, growing at a CAGR of 12.3%.

Next Steps for Summit

Summit will use the existing coarse reject from the recent drilling to undertake accelerated metallurgical and mineralogical programs to progress towards a geometallurgical model for Stallion.

The company will utilise the available POW-approved drilling to build further certainty and definition within the identified zone as a precursor to developing its potential maiden resource.

SUMMIT FPO

SUMMIT FPOPlease note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.