Sovereign (ASX:SVM) raise its rutile resource

April 5, 2023Sovereign Metals have uplifted Kasiya and raised the world’s largest natural rutile deposit and second largest flake graphite deposit’s indicated resource by over 80 per cent in the East African nation of Malawi.

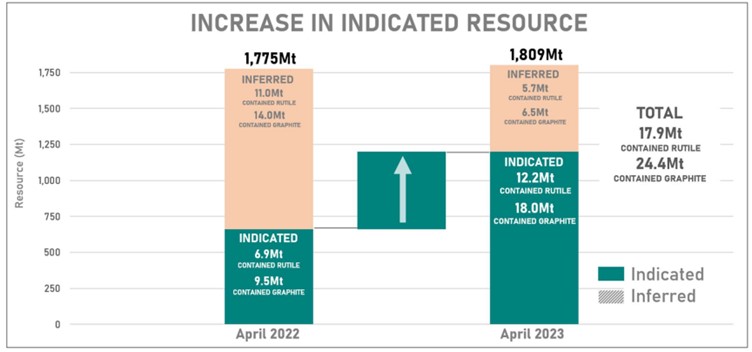

The updated MRE moved over half a billion tonnes from the inferred category to indicated for a global estimate exceeding 1.8 billion tonnes at 1% rutile and 1.4% graphite.

Sovereign Managing Director Dr Julian Stephens said that increasing over 80 per cent of its indicated component at a one-for-one conversion from inferred was an outstanding outcome.

“The conversion rate confirms the very consistent geological and grade continuity and is testament to the high-quality and robustness of the deposit,” he said.

“Kasiya is poised to become a major long-term supplier of the critical minerals natural rutile and graphite, with both forecast to be in near-term and significant supply deficit.”

“The PFS work program on this highly strategic and globally significant project is progressing well and approaching its final stages.”

An expanded scoping study has already demonstrated Kasiya as a globally significant project with enviable economics, envisaging a 25-year mine life producing both rutile and graphite at 12Mtpa in stage one, before doubling in stage 2, and this enhanced estimate is set to underpin the mining inventory and plan for an impending prefeasibility study for the project.

While rutile is the most abundant naturally occurring form of titanium dioxide, mineable deposits are scarce, particularly ones as large as Kasiya, and while long known for varied applications in manufacturing and industry, has been further uplifted in demand with new application discoveries in mineral research.

Increase in Kasiya’s Indicated Resources compared MRE update released in April 2022

SOVEREIGN FPO [SVM]

SOVEREIGN FPO [SVM]Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.