Green Technology Metals (ASX:GT1) ticks off key Seymour milestone

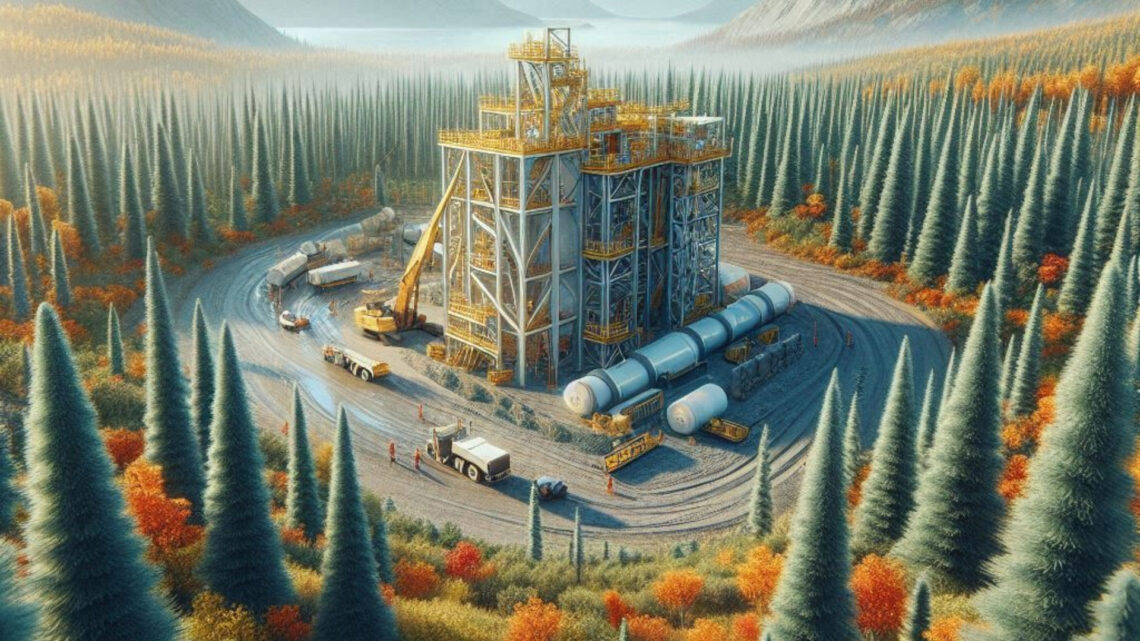

August 12, 2025 Off By MarketOpenGreen Technology Metals (ASX:GT1) has crossed another hurdle in its ambition to create a vertically integrated lithium business in Ontario, Canada, with the granting of two additional 21-year mining leases for its flagship Seymour Lithium Project.

The approvals from the Ontario Ministry of Mines mean Green Technology Metals now holds all three required leases covering the proposed mine and concentrator site, a major regulatory step forward in a permitting process that has been running in parallel with environmental and community engagement since the company acquired Seymour in 2021.

Highlights

-

Two new 21-year mining leases granted for Seymour.

-

All three required leases now secured, covering the proposed mine and concentrator.

-

Regulatory milestone de-risks pathway to development.

-

Provincial environmental assessment confirmed as sole requirement — no federal process.

-

Four years of sustained work and engagement with Indigenous partners.

-

Positions Seymour for a near-term financial investment decision, pending remaining permits.

In the lithium sector, permitting timelines can stretch out indefinitely, making today’s announcement more than just administrative progress.

For GT1, the leases are the culmination of four years of studies, engineering work and persistent consultation with Indigenous communities.

Managing director Cameron Henry said:

“Securing the required mining leases for Seymour significantly de-risks the project and provides the foundation for development of key infrastructure. This achievement reflects four years of sustained effort and a strong, collaborative relationship with the Ontario Ministry of Mines.”

The pathway ahead is now clearer, with provincial regulators confirming Seymour only requires a provincial environmental assessment, sidestepping the more onerous federal Impact Assessment Act process and this should streamline the timeline to final approvals.

The environmental assessment is on track for completion in the coming quarter, supported by seasonal baseline studies and targeted monitoring such as owl and fisheries surveys.

Meanwhile, work on the project’s Closure Plan, a critical requirement for construction approval is about 80 per cent complete, with final design details already submitted to authorities for review.

GT1’s approach to Indigenous engagement has been central to its permitting success.

The company maintains that,

“meaningful collaboration” is essential, and has incorporated Indigenous perspectives into project planning from the outset. In Henry’s words, “we sincerely thank our Indigenous partners and stakeholders for their ongoing engagement throughout this process.”

Beyond Seymour, GT1 controls a portfolio of high-grade hard rock spodumene projects in Ontario, including Root, Junior and Wisa, with a combined global resource of 30.4 million tonnes at 1.17 per cent Li₂O.

All are within reach of established infrastructure such as clean hydro-power, sealed roads and rail.

While the market focus is on supply deficits and downstream processing strategies, the more mundane, yet essential task of securing mining tenure is often where projects succeed or stall.

For GT1, Seymour’s leasing milestone adds weight to its claim of being on a well-defined path toward construction readiness and, ultimately, production.

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.