Castle (ASX:CDT) passes purity milestone at Kambale

February 5, 2024Castle Minerals has produced top-level purification results with 99.97% total graphitic carbon exceeding the EV anode benchmark and claimed a major production milestone and place in the critical minerals supply chain from its Kambale Graphite Project in Ghana.

Chinese export bans put a greater onus on finding graphite resources from within friendly borders, and UBS see a supply gap as soon as 2025 and a corresponding price surge emerging for natural graphite.

Africa has been well established as one of the more likely-looking places to find it in big, high-grade reserves, with Castle increasingly viewing Kambale as its tentpole operation.

Castle Managing Director Stephen Stone said an increase from less than 10% TGC to such a high purity was a fantastic achievement, and a great start to 2024.

“With no impurities of concern this exceeds the stringent specification benchmark set by off-takers who manufacture lithium-ion battery anodes used in electric vehicle, stationary power storage units and consumer electronics,” Mr Stone said.

“Kambale mineralisation is now confirmed as a bona-fide source of natural fine-flake graphite which is the exact form of graphite forecast to move into a substantial supply deficit as the rapid take-up of EVs continues.

“The billions of dollars that the USA and EU are directing to establishing and securing reliable non-China dependent supply lines of critical minerals like graphite means that Kambale is well placed to participate in this paradigm shift in market structure.”

Mr Stone added that Kambale was already large enough and, at 8.6% TGC, had the excellent grade to underpin a long-life operation in one of Africa’s most favourable jurisdictions, exemplified by a number of Tier-1 gold miners successfully operating for decades.

“We are just commencing a multi-disciplinary study to identify the optimal low-entry start-up capital approach to development which at this stage looks to be a phased, modularised, graphite concentration operation with an integrated, value-adding spheronisation facility,” he said.

“Once this is completed along with parallel activities Castle will be in a position to commence discussions with product off-takers, development and financing partners.

“The junior resource sector is challenging right now, and graphite has yet to emerge from under lithium’s shadow, but we are confident that both will turn in Castle’s favour and the substantial fundamental value of Kambale will be fully recognised in due course.”

Castle believes that while the result was a very successful first-pass assessment, it remains an unoptimised process, leaving open several opportunities to optimise recoveries and flowsheet design from a recently enhanced 22.4 million tonnes at 8.6% TGC resource.

But with the milestone checked off, the explorer can advance, and has begun work to assess the Kambale material’s charging and performance characteristics and engaged a team of specialists to undertake a high-level assessment of establishing a mining and processing operation at its emerging flagship project.

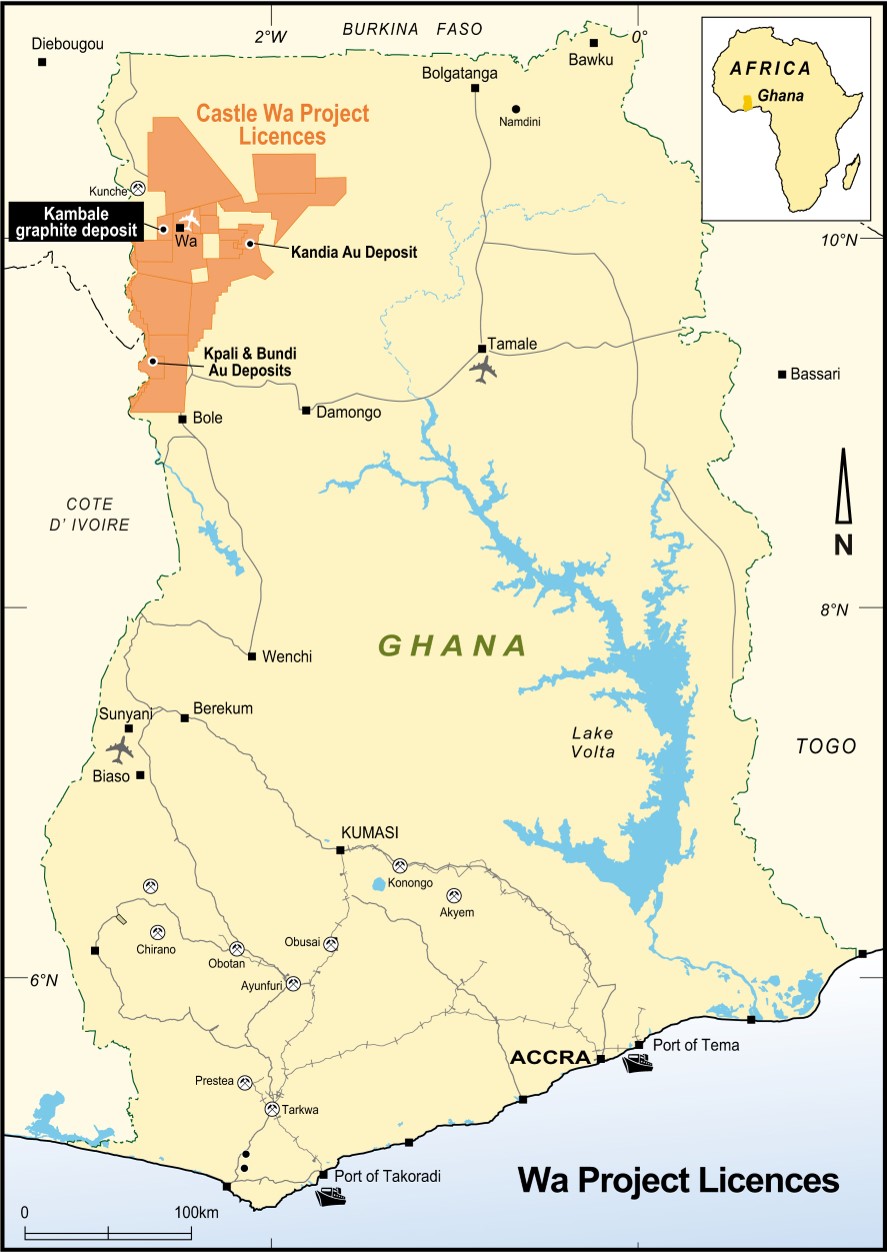

Castle’s ground in Ghana

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.