Market Open Radar: Salinas fever makes investors Latin lovers

October 23, 2023Western Australia’s Latin Resources is gaining attention for its aggressive drill campaign at the Salinas project in Brazil. The lithium project, now district-scale size at Colina, shows promising results from lab assays. With its mineral resource update imminent, the company is a contender for the big time.

A lithium gainer

WA company Latin Resources (ASX:LRS, FRA:XL5) has projects in South America and Australia and aims to develop sustainable materials for environmentally friendly products across the globe.

The $698 million company, whose securities went into a trading halt on Thursday, has gained 165% in the past 12 months, making it the biggest lithium gainer on the Australian Securities Exchange in the past year.

A scoping study for the projects puts its net present value (NPV8%) at US$2.5 billion ($4 billion), with an internal rate of return of 132%.

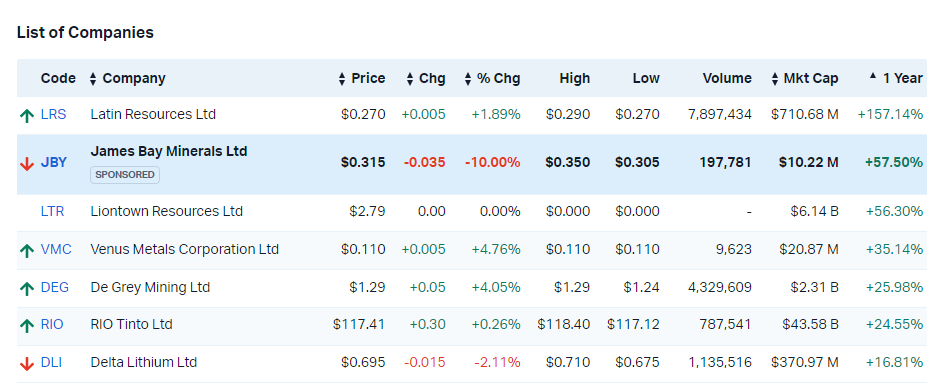

Last year’s lithium gainers on the ASX

A big project

While the company has lithium and graphite assets globally, its tenements in Brazil’s Minas Gerais region near neighbour Sigma (NASDAQ:SGML) attract the most attention.

Earlier this year, Latin Resources upgraded its Colina deposit near Salinas to an impressive district scale of 45.2 million tonnes at 1.32% Li2O.

The company has a thick-pegmatite swarm at Colina that measures two kilometres by 1km, leaving plenty of upside for the Latin team embarking on 65,000 metres of drilling.

Latin’s team, which includes experienced senior geologist, Latin Resources Vice-President of Operations in the Americas Anthony Greenaway, hopes to use the latest results for its highly anticipated updated mineral resource estimate for Colina before the end of the year.

The Salinas-Colina project team plans to keep its drill rigs spinning throughout 2024, focusing efforts on Colina and Fog’s Block.

The scope

The preliminary economic assessment for the Salinas-Colina project will extract concentrate varieties from raw materials in Colina using the more economical dense media separation technique. Its first product, SC5.5, will have a grading of 5.5% Li2O, while the second product, SC3, will have 3% Li2O. It aims to produce an average of 405 kilotonnes of SC5.5 and 123ktpa of SC3 yearly.

According to the PEA, all-in sustaining costs would be US$536/tonne, anticipating a US$253 million capital expenditure for Phase 1 and US$55 million for Phase 2.

Assuming conservative prices of US$1,699 per ton for SC5.5 and US$927 per ton, the investment would pay off in seven months. Some bullish estimates predict a long-term price of US$2,500 per ton for SC5.5, while sellers of SC6 received about US$3,120 per ton for 6% Li2O concentrate in late September.

Next steps

Latin Resources is expected to update its mineral resources for the Salinas-Colina project by the end of the year.

Once done, the company will start working on its definitive feasibility study (DFS). This study is critical because it will ensure the company can meet its expected final investment decision in 2024.

Assuming the DFS is successful, the company plans to start mine construction in 2025 and have its first production in 2026.

Advantages

The Salinas-Colina lithium project has promising potential in size, cost, mine life, and profitability under the leadership of a highly experienced and diverse project team.

It could only take seven months to start making a profit after production begins. Given its significant resources and estimated value, the company is well-positioned to benefit from the growing demand for lithium. The management team has extensive experience in mining and exploration, financing, and the corporate sector.

Challenges

Latin Resources offers a high-risk, high-reward investment in the future of the lithium industry. However, the flagship Salinas-Colina project is in its early stages and is not guaranteed to become a mine. The company hasn’t generated revenue yet, so profits are uncertain. The securities are expected to return to trade on Tuesday.

Update: Latin today announced firm commitments for a $35 million placement to progress exploration at Salinas and is now back trading on the ASX.

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.