Antilles’ (ASX:AAU) new resource opens door for Cuban copper-gold

March 6, 2024Antilles Gold has received a resource estimate for the top 150 metres of the Nueva Sabana deposit, returning 110.5 thousand ounces of gold and 52 million pounds of copper to enable completion of a scoping study over its even-split joint venture with state-owned operations in central Cuba.

The study is expected by month’s end, with Antilles Gold expecting to see a short initial mine life with heady economics from the shallows of Nueva Sabana.

The deposit, composed of three mineralised zones, will offer early concentrate sales from the overlying gold domain before moving to a copper-gold zone, and a deeper copper prize believed to transition at depth to an offset El Pilar porphyry deposit.

Concessions will not limit the depth of mining to shallow confines, allowing a deeper expansion into recently identified copper into the oxide zone and underlying El Pilar.

“The company was confident that with the permitted increased mining depth, and further exploration, both the mine life, and the project value would increase considerably,” Antilles Chairman Brian Johnson said.

Mine construction is planned to begin in July and take a scant 10 months if the scoping study matches expectations, and place Antilles as a producer at the forefront of a refiring Cuban mining sector.

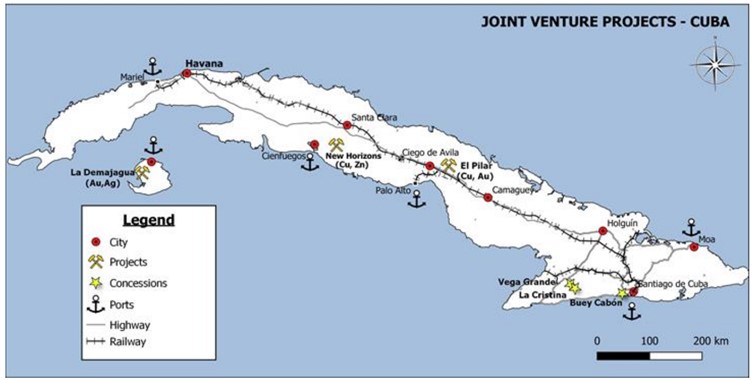

Antilles holds a 17,000-hectare reconnaissance permit surrounding Nueva Sabana ready for exploration, and a La Demajagua mine to the southwest offers near-term prospects of gold, silver, and antimony production.

While Nueva Sabana is essentially a copper play with added gold credits, early concentrate sales from widespread shallow oxide gold offers the cheap cash to fund a busy joint venture with GeoMinera.

The partners intend to invest part of surplus cash from early mine developments to continue exploration, focusing on the El Pilar copper-gold porphyry system and three highly prospective properties to the southwest in the Carribean nation’s Sierra Maestra copper belt.

While Cuban mining investment has been largely ignored for decades, rich mineral reserves, favourable regulations, and a strategic US-adjacent location would not escape attention for long.

Trafigura Group’s US$278 million ($423.5 million) venture with GeoMinera revitalised a historic Castellanos site now standing as the world’s largest lead-producing surface mine.

And Antilles has been granted a generous fiscal regime from Havana, with the Bowral-based explorer bullish with the Cuban authorities at its back so it can soon begin production.

Antilles has provided a table detailing the Nueva Sabana resource estimate

Antilles shares its Nueva Sabana joint venture project location map

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.