Everest (ASX:EMC) enters Stelar JV in historic Broken Hill

February 13, 2023 0 By Rueben HaleEverest Metals has again bolstered its lithium portfolio, entering an exclusive binding joint venture partnership with with Stelar Metals (ASX: SLB) on Stelar’s Trident, Midas and Perseus sites, part of its Broken Hill Projects portfolio in far west outback New South Wales.

Under the deal, EMC is to retain 10% Free-Carry JV Interest until a pending feasibility study is delivered, coming with it a decision to mine upon. After that, EMC can contribute or convert to 1.5 per cent Net Smelter Royalty.

“The Joint Venture of the NSW assets is consistent with EMC’s strategic focus on its near-term West Australian Gold and Battery Metal Projects,” CEO Mark Caruso said.

“The Transaction with Stelar further enhances EMC’s excellent exposure to lithium through the RTX JV at Rover and the recent Mt Edon Acquisition.”

Project Information

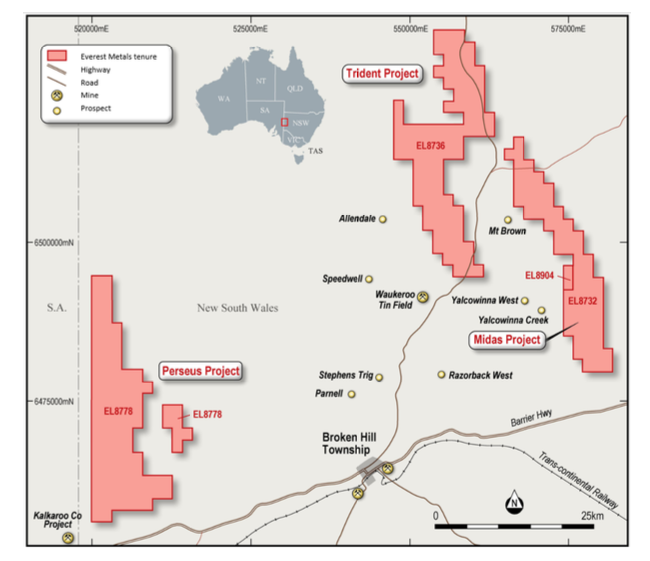

Covering a combined 753km2, the Company has one of the most extensive license holdings in the Broken Hill area, all within ~50km of Broken Hill.

EMC’s Broken Hill tenements

The Company has identified compelling IOCG targets at the Benco prospect within the Midas Project, which is drill ready. For the Trident project, the Company reported assay results from its first pass rock chip sampling programme in 2021 and identified six high-priority IOCG targets for testing.

Midas Cu-Au Project

The Midas Cu-Au Project (“Midas”) is prospective for Iron-Oxide-Copper-Gold (“IOCG”). It is located 40km northeast of Broken Hill and adjacent to Silver City Minerals (ASX: SCI) Yalcowinna Tenement. Several areas of strong Cu-Au anomalism have already been defined across the Midas Project through soil and rock chip sampling programmes.

Perseus IOCG Project

The Perseus Project (“Perseus”) is prospective for IOCG mineralisation and is located ~50km west of Broken Hill and north of the Thackaringa Cobalt Project. In 2018 EMC identified six high-priority IOCG targets for testing, and the Geological Survey of NSW’s November 2018 Mineral Potential Report for the Curnamona ranked three of the six high-priority Perseus targets as highly prospective.

Trident IOCG Project

EMC’s Trident Project (“Trident”) is prospective for IOCG and tin. Located ~35km north-east of Broken Hill within the Curnamona Craton, it is hosted in an ovoid-shaped craton of Paleoproterozoic to Mesoproterozoic rocks of the Willyama Supergroup (1720-1640Ms), which hosts the Broken Hill strata bound lead-zinc-silver deposits and numerous small metalliferous occurrences. In 2021 EMC identified strong copper, gold, and tin mineralisation at Trident.

Price Action

Everest Metals (ASX:EMC) shares are 9.1c in today’s early morning trade.

About the Deal

The Key Terms of the Agreement with SLB to Join Venture the Company’s three NSW projects include:

- SLB will pay $250,000 cash to EMC on the Agreement signing.

- SLB will also issue1 fully paid Stelar Shares to EMC that are equal in value to $250,000 divided by the volume-weighted average price of the Shares as traded on the ASX over the 10 days immediately before the date of the Agreement (“Issue Price”).

- An additional Milestone Payment will be paid to EMC once drilling commences at the Midas Project or the NSW regulators grant drilling approvals for drilling at the Trident Project. The Milestone Payment will comprise either SLB issuing 1 fully paid SLB Share to the value of $500,000 at the same Issue Price determined at the date of the Agreement or a cash payment by SLB to EMC of $500,000. This is at the sole election of EMC.

- SLB will become the Managers of the projects, and 90% of legal title will be transferred to SLB’s subsidiary BR2 Pty Ltd. EMC will retain free-carry for their 10% interest until SLB presents a Feasibility Study and a Decision to Mine.

- After the free-carry period, EMC will either contribute 10% to all ongoing costs or dilute to a 1.5% Net Smelter Royalty (NSR).

- Conditions Precedent include the satisfaction (or waiver at the discretion of BR2) of the following:

o Completion of legal and technical due diligence by BR2 on the Assets and Everest, to the satisfaction of BR2 in its sole discretion within 15 business days,

o BR2 obtaining board approval to give effect to the terms of the Acquisition within 5 Business Days of the Execution Date;

o BR2obtainingallnecessaryregulatory, shareholder and third-party approvals (including any necessary ASX Listing Rule approvals) or consents to allow BR2 to complete the Acquisition lawfully.

Fundamental Data

Please note the following valuable information before using this website.

Independent Research

Market Open Australia is intended to be used only for educational and informative purposes, and any information on this website should not be taken as investment advice or guidance. It is important to conduct your own research before making any investment decisions, which should be based on your own investment needs and personal circumstances. Any investment decisions based on information contained on this website should be taken in line with independent financial advice from a qualified professional or should be independently researched and verified.